Introduction

90% of the US economy is offline. Walk into your regional bank, your local insurance broker or a hospital and chances are you are filling out paperwork, waiting for someone to retrieve information for you, and more generally making decisions with a fraction of the data you would have in the digital domain.

In the background, there is an equal amount of paper pushing, manual data retrieval and a shocking number of faxes (100 billion/day) performed by employees. As digital consumers, it can be hard to fathom how antiquated these business processes are. We are used to digital Amazon purchases that magically show up at our door with one click, Google search results that give us information instantly and WhatsApp for communication that makes the idea of sending a fax seem like a relic from a bygone era.

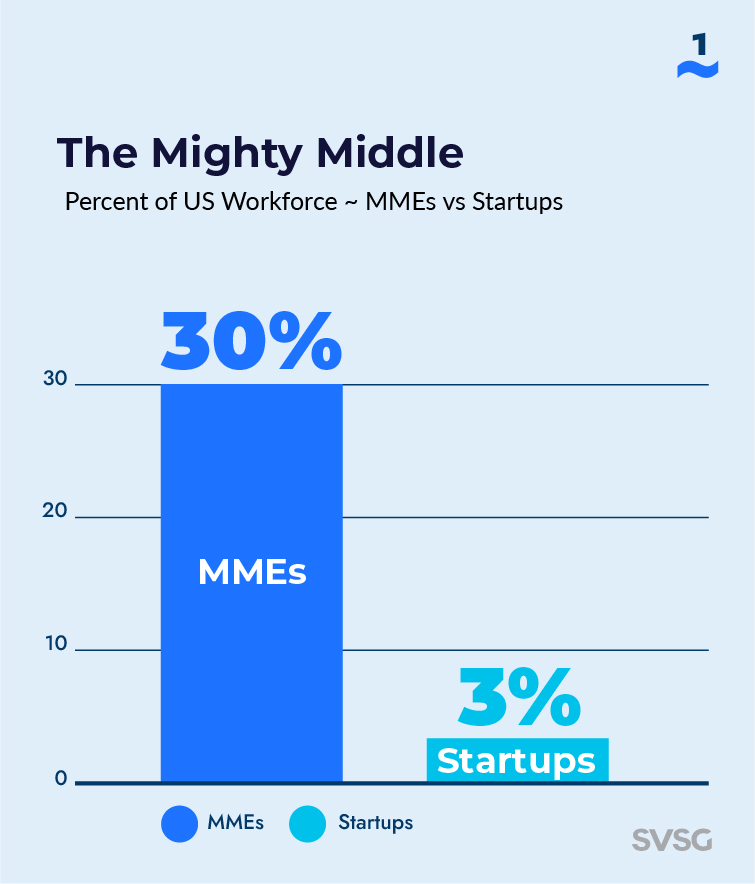

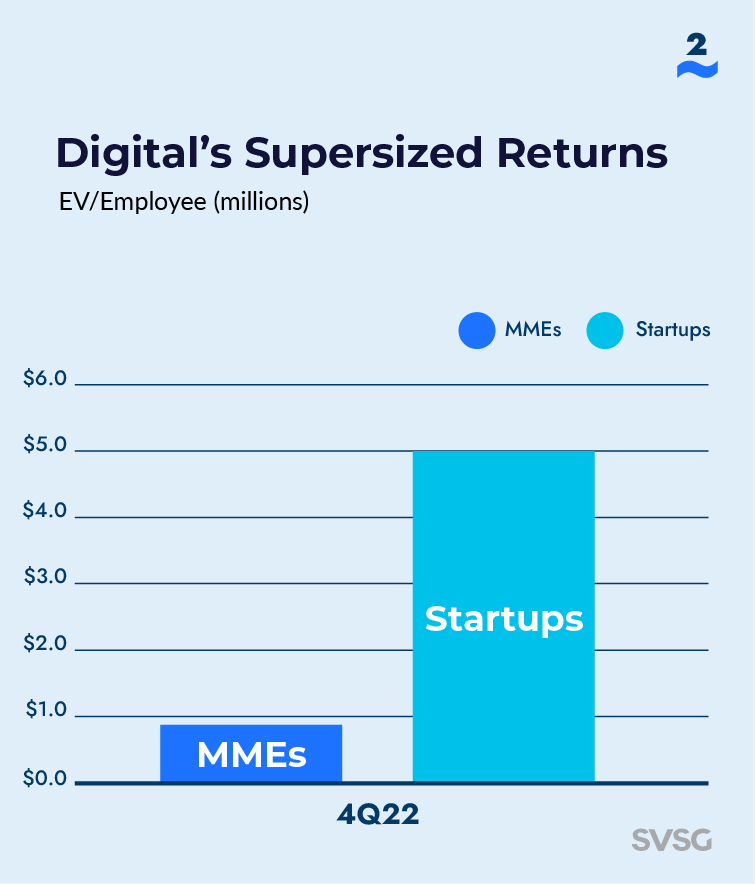

But most business operations are still operating offline. A giant chunk of these offline businesses are Middle Market Enterprises (MMEs), loosely defined as businesses with 10m-1B in revenues. MMEs employ 30% of the workforce, but produce 20% of the value per employee compared with startups. Moreover, these offline businesses tend to leave customers and employees more frustrated than their digital counterparts.

In this post, we will explore what would happen if MMEs were to operate more like the digital-first startups from the Silicon Valley that are disrupting them. We’ll explore the impact from three perspectives: investor returns, US economic competitiveness, and society’s overall well-being.

Comparing startups to MMEs

Startups have had an incredible run. Over the past decade, venture capital has poured $800B into these disruptive companies that have won over consumers through superior customer experience. Digital experiences have disrupted the way we purchase goods, the way we communicate and the way we navigate the world – try to imagine driving with a physical map.

Much of this disruption has been at the expense of the Middle Market, but at 33% of the US economy, the Middle Market is massive. While we can expect to see startups continue to eat into MME market share, it is an interesting question to ask what would happen if the Middle Market digitized and became more like the startups that are disrupting them?

Here are a few data points to help us explore this question:

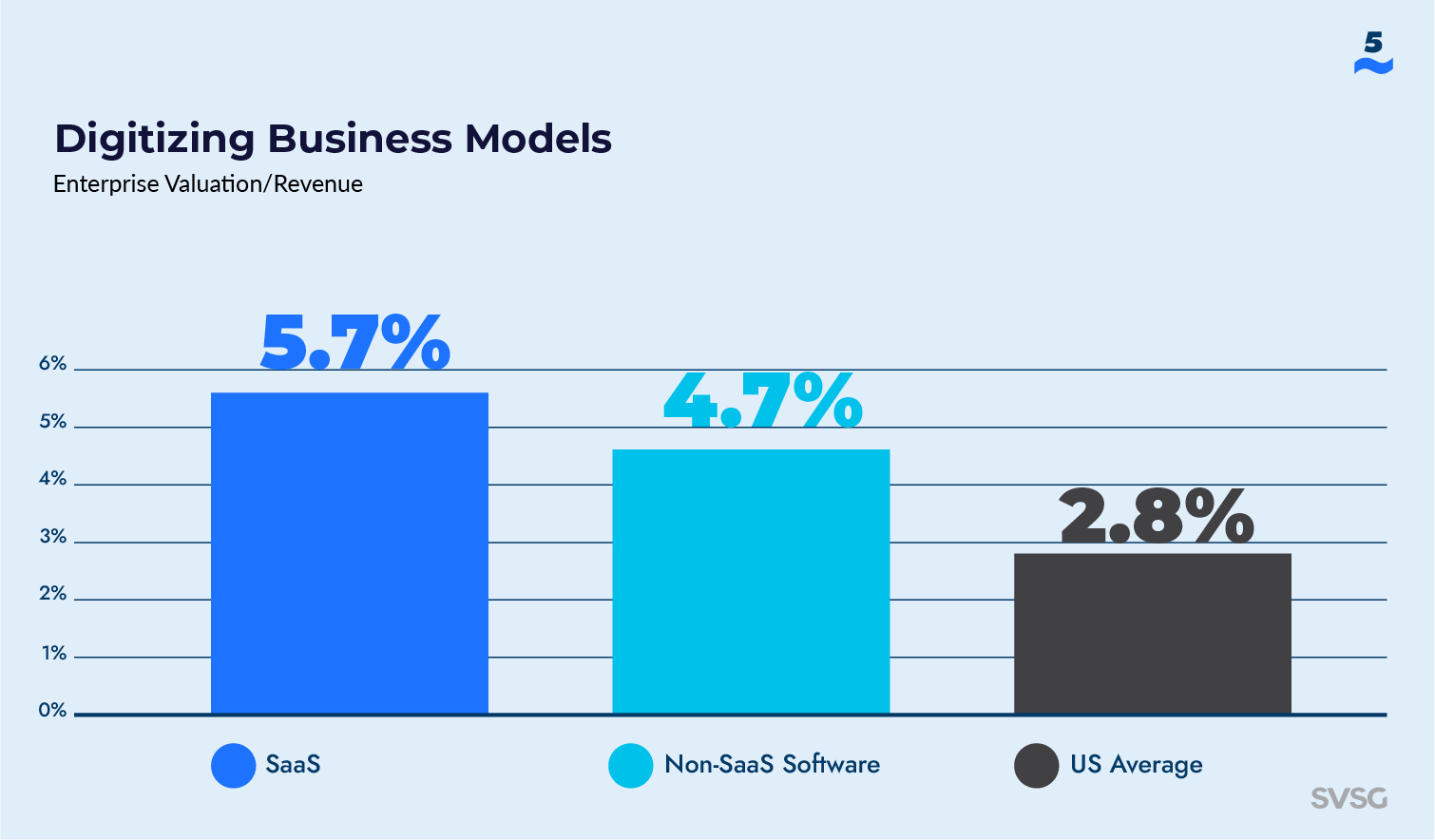

Source: Russell 3000, YahooFinance, Crunchbase, GeekWire

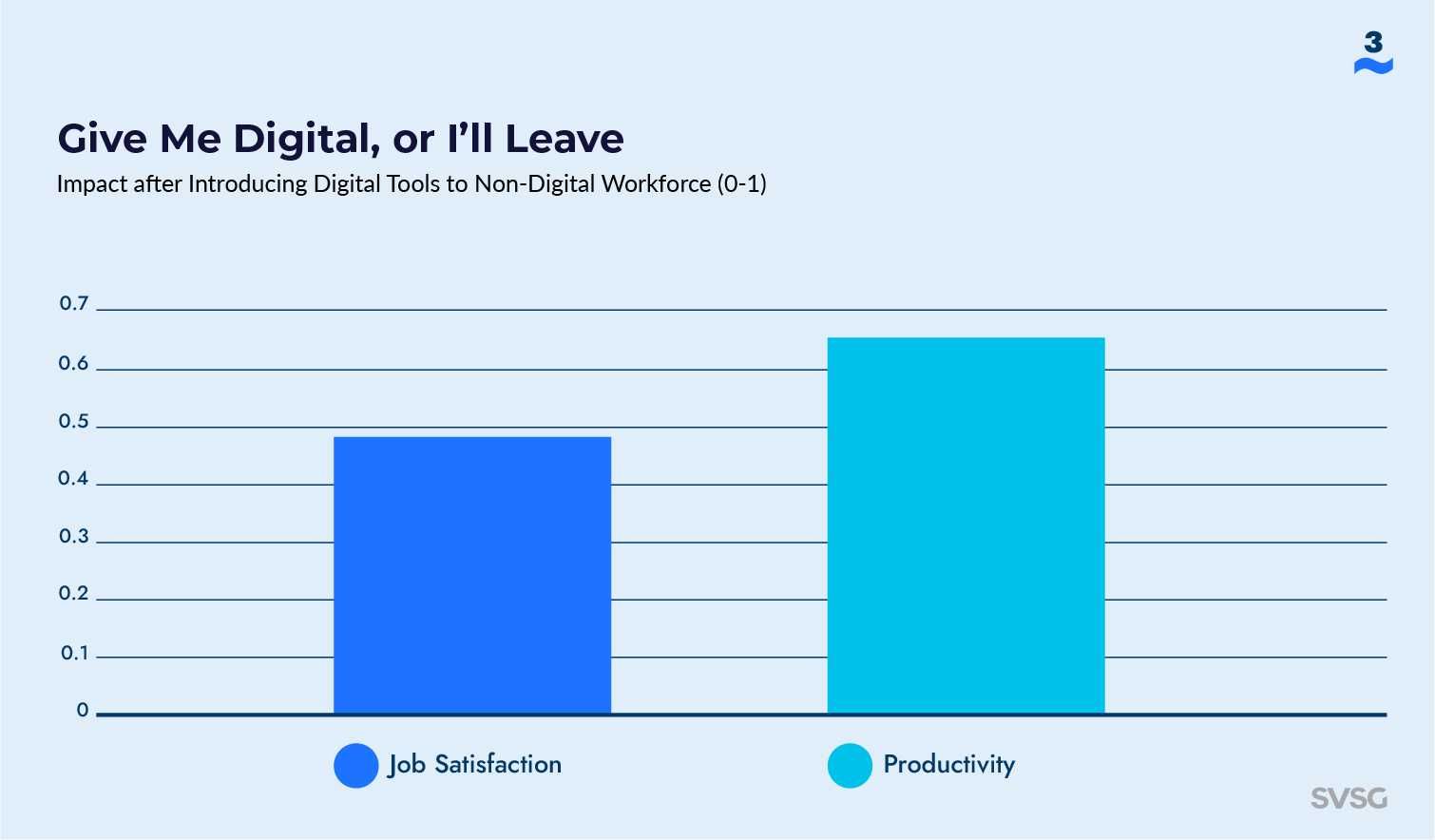

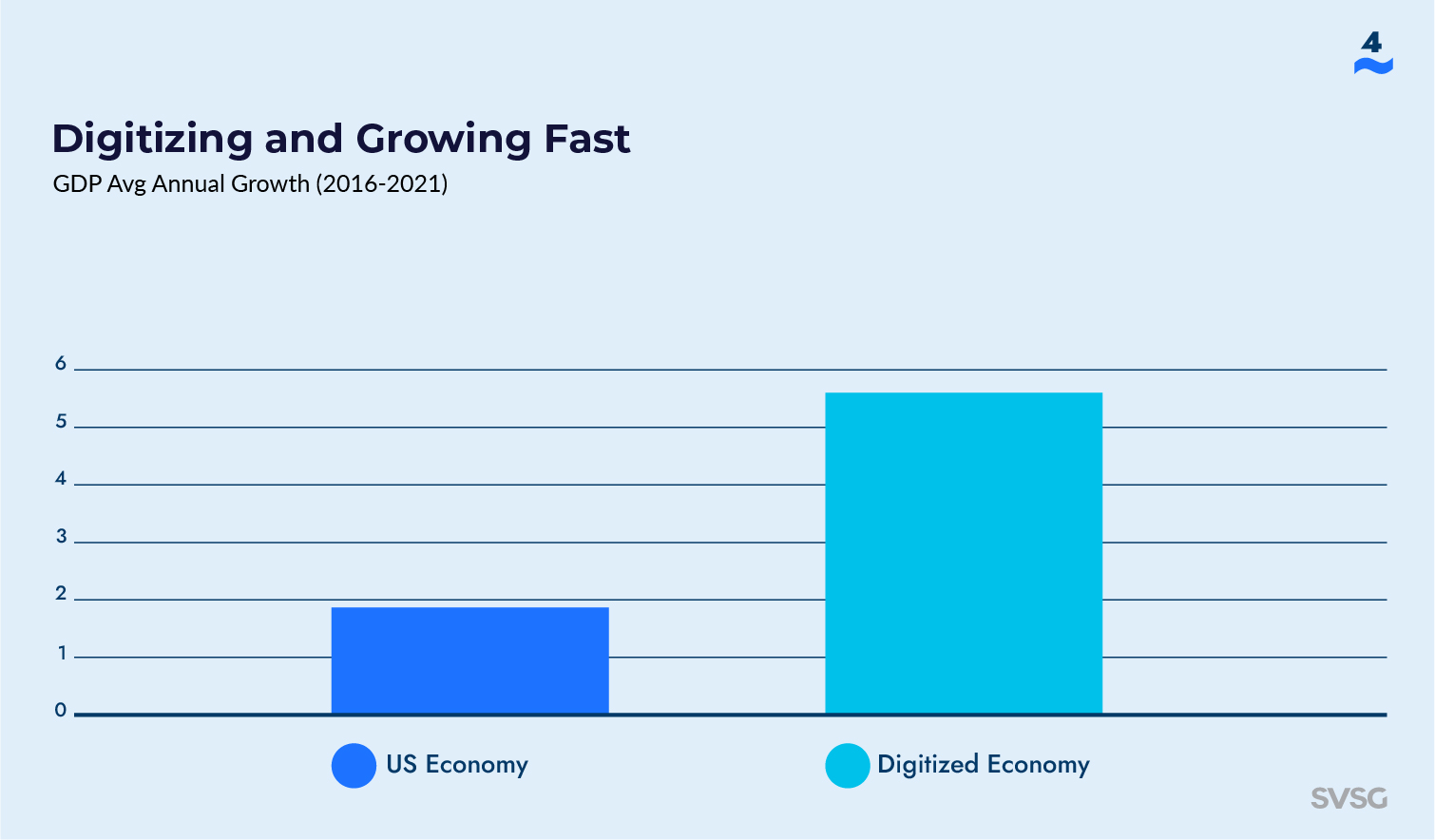

We can account for these gaps in a number of ways, but the common denominator is the digital divide. The digital economy is growing 3X faster than offline GDP, and digital business models allow for subscription services that command 2X higher valuation multiples. Customer experience improves for businesses that have been digitized. And digitally enabled workforces are more productive and happier. In sum, startups are digital-first; MMEs are a digital laggards.

Closing the digital divide

So what would happen if MMEs were digitized? In short, if the middle market were as digital savvy as their startup disruptors, we would see incredible wealth creation, an overdue productivity bump that would help pay off national debt, and an overall improvement to our collective day-to-day experiences.

With all of this promise, there are many obstacles that stand in the way. Embracing digital is not just about picking the right tools, its equally about shifting a company’s mindset and culture. Many the MME has tried to digitally transform only to see a burning hole in their balance sheet and a workforce stuck in their old ways. 70% of digital transformations fail. In the next post, we’ll look at the main hinderances we see holding back MME from digitizing.