Written by SVSG CTO & AI Practice Lead Geeta Chauhan

The integration of AI and Deep Learning into the financial industry isn’t stopping anytime soon.

The AI revolution is growing. Gartner predicts by 2018, 80% of data scientists will have deep learning in their toolkits and by 2019, deep learning will be a critical driver for best-in-class performance for demand, fraud and failure predictions.

Companies who are already privy to this revolution will stay ahead of the game. You don’t have to be Google or Facebook to benefit from the use of AI and Deep Learning. Start-ups and other enterprises are already making huge gains with emerging technology.

Despite these advances, some executives, companies, and enterprises hesitate due to misconceptions about the value, utility and accessibility of this technology. If you’re ready to get onboard, check out some of the most common questions asked by executives considering the utility of AI/Deep Learning Technology in their financial industry.

Q1. Where’s the evidence for the rise of deep learning?

It’s clear that the AI revolution is already well underway whether you look at hyper-scalers like Google, Facebook, Amazon, and Microsoft or start-ups. AI and Deep Learning (DL) isn’t just about chatbots. Deep Learning can solve complex and data-rich business problems while benefiting innovations from computer vision, natural language processing, speech translation, to real-time object detection in videos. Deep learning can interpret medical images to diagnose cancer, improve the sight of those with vision problems, control self-driving vehicles, and recognize or understand a specific person’s speech. The possibilities are limitless.

This revolution has been enabled by access to large volumes of data, cheap computational abilities and open competition along with increased sharing of knowledge and resources (on platforms like arxiv.org).

Recent advances in DL have taken the AI community by storm. Early innovators in the financial sphere are already capitalizing on this trend. For example, PayPal is using deep learning as an approach to block fraudulent payments “and has cut its false-alarm rate in half.” CBInsight’s latest “AI in FinTech Market Map” is already tracking 100+ Fintech companies leveraging AI.

Q2. How is deep learning transforming the world of FinTech?

We know that hyperscalers like Google, Facebook, Amazon, and Microsoft have proven the benefits of Deep Learning for scenarios ranging from computer vision, natural language processing, speech translation, and real-time object detection in videos.

If you’re looking for more evidence about the increasing utility of AI and DL in the FinTech space, here are a few examples:

- Alpaca.ai is using image recognition for enabling consumers to build visual trading strategies based on chart patterns and technical analysis. Previously, traders started with huge amounts of data that required onerous and resource-intensive processing With Alpaca.ai, you start by highlighting your winning trades in a historical chart, and Algaca’s deep learning engine learns those strategies and generates your own unique trading algorithm.

- NumeraAI has built an AI-based hedge fund. Numerai uses a cryptographic token to incentivize data scientists around the world to integrate AI into hedge funds, essentially moving Wall Street to an “open source” type of model.

- FeedZai, a fraud insight platform, uses machine learning (ML) and deep learning for fraud detection across multiple streams of data.

- ZestFinance is using AI & Deep Learning for credit scoring and underwriting lending applications. Again, deep learning demonstrates that AI has the potential to help automate repetitive and resource-intensive tasks.

- Prediction Machines took a tip from Google’s AlphaGo. Open AI’s Open Gym has open sourced their reinforcement learning-based trading gym.

- Kabbage, an alternative lending provider, is using deep learning for fraud detection. It works by using autoencoders for anomaly detection and social network analysis to pinpoint bad customers

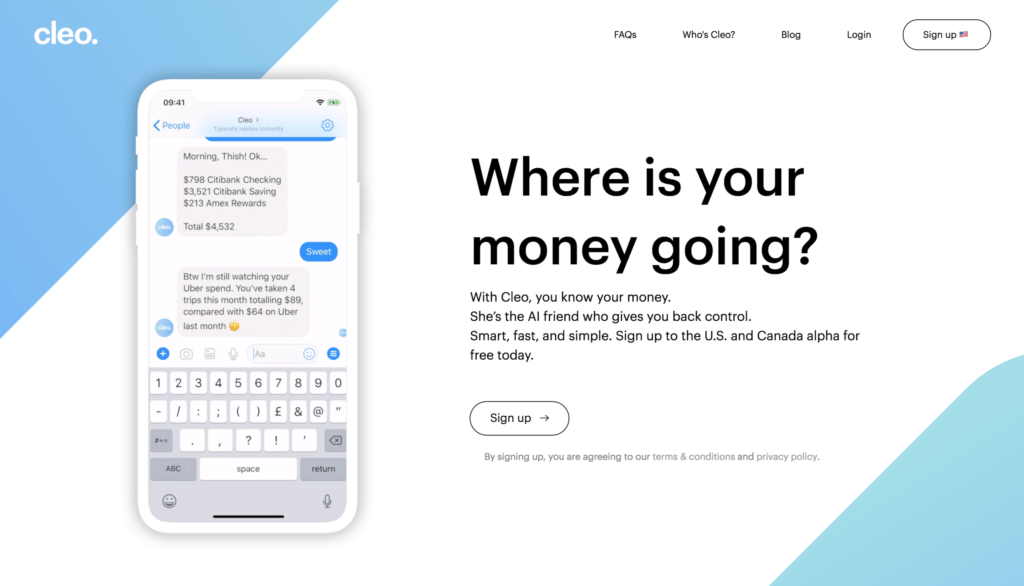

- Cleo AI has built a personal assistant and chatbot to help manage personal finances

Founded in 2016, Cleo is an AI assistant that intelligently manages your money

Q3. Why is it crucial for businesses to pay attention to these deep learning developments?

With the digitization of the economy, businesses are evolving more rapidly than ever. Consumers expect personalized services tailored to their situation with real results. Customers want instant gratification, and sophisticated deep learning technology has the potential to provide this. Data-driven businesses are able to offer more competitive services by leveraging AI. Consider Paypal: after adopting AI and Deep Learning, Paypal saw savings of $700 million in anti-fraud activities in just the first year of implementation. Businesses and consumers alike want to know their data is safe, and performing fraud detection analysis in real-time allows companies to stop fraud before it begins.

Organizations benefit from AI and DL because the system learns more with every single transaction—automatic pattern detection can glean significant insights. In the past, knowledge of the system and its workers was limited to individual insights or business silos. Deep learning makes this information accessible to executives and reliable enough to factor into decision-making.

Further, one of the biggest benefits of Deep Learning is the ability to learn latent features from the data. Businesses no longer have to code in all the business rules and do feature engineering, which requires considerable investments in building and maintaining the systems. When there is a large number of features across diverse data sets, feature engineering becomes impractical for building personalized services. Deep Learning is the answer.

Q4. How is the deep learning revolution already affecting the larger marketplace? What changes can we anticipate in the coming year?

According to Andrew Ng, worldwide leading authority in AI and Deep Learning, “AI is the new electricity”. We are already seeing the impact of this with large hyperscale companies: Alexa’s voice recognition services, facial detection in Facebook images, and the increasing sophistication of Apple’s iPhones. Google Translate has surpassed human translators and can even transfer deep learning of known languages to the learning of new languages. It was recently found that skin cancer detection using Deep Learning surpassed the best doctors. Similarly, self-driving cars are becoming a near reality with Deep Learning, and we can only expect this to continue as we see more and more rollouts. Gartner predicts that by 2019 deep learning will be used for best-in-class solutions for Demand, Fraud and Failure predictions, and by 2023 AI and Deep Learning will be the most common approaches for new applications of Data Science.

Q5. How do I get started with implementing DL technology in my FinTech endeavor to unlock value and build competitive advantages?

With my clients, I advocate a practical use and case-driven approach for adoption of any new technology and initiative. One of the most critical factors for success is the decision to lead with a business problem rather than leading with technology. Technology exists to solve problems—begin with those. Depending upon the state of AI and Data Analytics initiatives in your Enterprise, you can take following actions to unlock value for your business and build competitive edge:

Applications like Lenddo are bridging the gap for those who want to apply for a loan in the developing world, but have no credit history for the bank to review.

Level 1: Just Starting

Start with lower risk use cases like adopting AI-driven customer services for your customer engagement. This includes systems like Chatbots to help your customer service agents become super-agents. For field sales and customers, you can use IBM Watson for Voice and you can automate redundant back-office processes using RPA (Robotic Process Automation).

Level 2: Intermediate/Mid-level

Invest in data cleansing and provenance for building richer systems. Once you clean your data, you can combine third-party data sets with your in-house data to offer more personalized service.

Level 3: Advanced

Experiment with deep learning models for complex problems like predictions for high variance use cases, or, innovative use cases for new service offerings like facial recognition for your banking mobile apps, or building a new type of insurance for the gig-economy.

Level 4: Mature

You can take your AI implementation to the next level by adding a feedback loop to your models which will allow you to learn from real outcomes. Beyond this, you can experiment with Deep Reinforcement Learning or start to industrialize the ML/DL pipeline and build shared model repositories across your company.

To start implementing or optimizing your AI, +1 844 946 SVSG today.