Written by Bernard Fraenkel, Enterprise Practice Lead at Silicon Valley Software Group.

Can you picture the day when your car insurance bill drops every month?

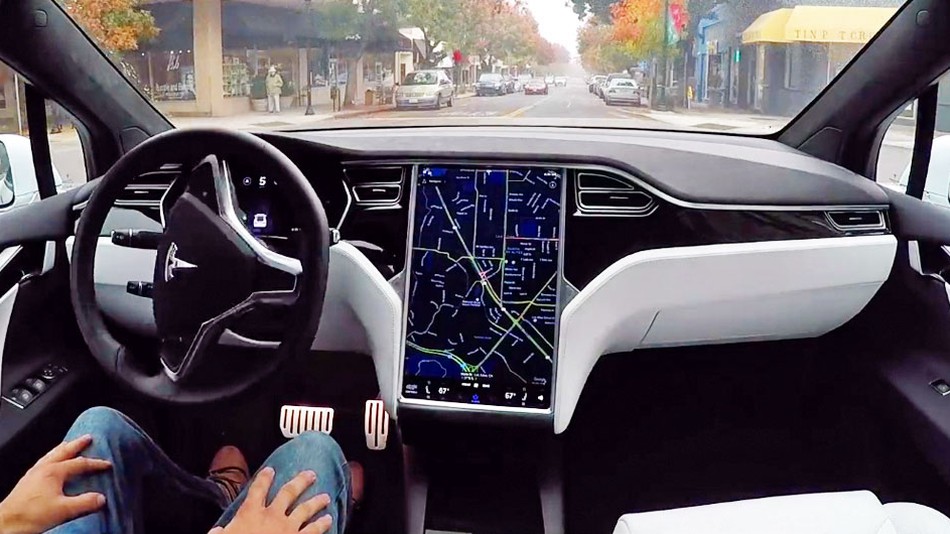

This could very well happen as self-driving car manufacturers (SDCMs) take over the car insurance business.

As it turns out, SDCMs have several powerful incentives to do so.

Their primary motivation is to remove an adoption barrier to self-driving cars: The cost, and even the availability, of car insurance could be a deterrent when purchasing an autonomous vehicle for consumers, as well as the new generation of “taxi” companies. Today’s incumbent car insurance companies do not have statistical tables for accidents and fatalities for self-driving cars since self-driving cars are not yet in circulation. As a consequence, they are likely to be conservative and set high initial costs for insuring autonomous vehicles.

By contrast, SDCMs will have the next best thing to real-life statistics — they have data centers full of data not only about accidents but also about near misses (albeit for their own cars only). This means they can generate accurate statistics about accidents of their own cars as often as they want and thus estimate the cost to insure their cars. An SDCM will be able to turn a barrier to adoption into a potential sale.

IMAGE: TESLA MOTORS

IMAGE: TESLA MOTORS

Furthermore, by offering car insurance themselves, the self-driving car manufacturers not only remove a barrier to adoption to their product but they also project confidence in their product. In addition, SDCMs will improve a customer’s purchase experience by eliminating one painful step in the car purchase process (because who enjoys shopping for car insurance?), as well as eliminate a third party in the process. Even better, pricing for car insurance will be greatly simplified since the most important variable in the pricing equations — the human — will be taken out of the system. The price of insurance will be determined by the hardware and software installed in the car — not by the human driver. Whether it’s a 16-year-old who just passed their driver’s license exam, a soccer mom with 15 years of accident-free driving or a retired senior, the price will be the same assuming the technology in the car is the same in all three scenarios.