SVSG CTO Geeta Chauhan quoted in Business Insider

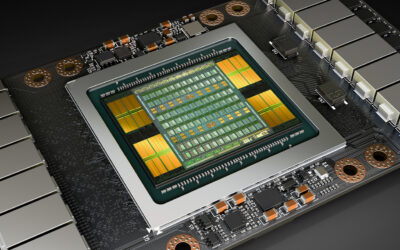

Courtesy of elitegamer.com Nvidia recently announced a new graphics-processing unit (GPU) capable of supporting 8K video playback. "With the launch of the Turing chip this week, Nvidia has solidified its market leadership position in the graphics and AI space," Geeta...

SVSG in U.S. News & World Report: Tesla Stock Soars Despite Losses

Losing money and topping Wall Street's expectations... Tesla recently released earnings for Q2 which reported a loss of approximately $3.06 per share. In contrast, Tesla revenue numbers have soared which may help explain the 5% growth in stock price. Saudi Arabia may...

SVSG on Bloomberg Radio: Elon Musk Considers Taking Tesla Private

On Bloomberg Radio with Bryan Curtis and Rishaad Salaamat, Matt Swanson - Managing Partner of Silicon Valley Software Group shares his views on Elon Musk's recent consideration to take Tesla Private. On August 7, 2018 at 9:48 AM, Elon Musk released a tweet stating...

Entrepreneur: Is That New Tech (Chatbots, AI, Blockchain) Really Valuable for Your Business? How to Find Out.

Finding the best fit... There are some exciting new technology options that can push your business to the forefront of innovation. But how do you know which technology is the most valuable fit? One technology which has been receiving a great deal of consideration and...

SVSG on Bloomberg Radio: How Artificial Intelligence Can Improve Jobs & The Workforce

On Bloomberg Markets with Carol Massar, Matt Swanson - Managing Partner of Silicon Valley Software Group discusses how Artificial Intelligence can improve jobs & the workforce. Jim Whitehurst CEO Red Hat talks recent earnings and rethinking the organization in our...

Prediction: Self-Driving Car Manufacturers Will Own The Car Insurance Business

Written by Bernard Fraenkel, Enterprise Practice Lead at Silicon Valley Software Group. Can you picture the day when your car insurance bill drops every month? This could very well happen as self-driving car manufacturers (SDCMs) take over the car insurance business....

CNBC Closing Bell: What Major Tech Stocks Are Worth Buying In The Second Half Of 2018?

Matt Swanson, SVSG managing partner, and Bruderman Brothers Vice Chairman Oliver Pursche, discuss whether the major tech stocks are still worth buying in the second half of the year. Too high, too expensive, or too fast? The Fab Four, better known as the FANG stocks,...

TechTarget interviews Bernard Fraenkel on why data managers should study up on GPU deep learning

As GPU deep learning becomes more common, data managers will have to navigate several new layers of complexity in their quest to build or buy suitable data infrastructure. AI-related deep learning and machine learning techniques have become a common area of discussion...

Inc. Magazine puts SVSG as #1 of the top 5 growing consulting firms evolving to modernize companies

Last year, the global consulting market was worth more than $250 billion, with one company alone making $37 billion. Some companies shy away from pulling on consultancies, reasoning that they should be able to solve their problems internally or that consultants will...

For Machine Learning, It’s All About GPUs

Isn’t it curious that two of the top conferences on artificial intelligence are organized by NVIDIA and Intel? What do chip companies have to teach us about algorithms? The answer is that nowadays, for machine learning (ML), and particularly deep learning (DL), it’s...

How Machine Learning Will Disrupt The Established Cloud Providers

Advances in Machine Learning (ML) and Deep Learning (DL) technologies and techniques put greater demand on data centers and ML-optimized compute resources and bring a new wave of disruption to cloud providers. This will impact Amazon AWS, Microsoft Azure and other...

Interview with SVSG Financial Services Practice Manager Carter Smyth

The following post is an interview with SVSG CTO and Financial Services Practice Manager Carter Smyth. Carter is an executive with over 25 years experience building technology teams to solve enterprise challenges in the financial services industry. He has extensive experience leading software development teams, business process reengineering, and global expansion projects. Carter joined SVSG in March 2017.

The Machine Learning Imperative

There’s no longer a debate as to whether companies should invest in machine learning (ML); rather, the question is, “Do you have a valid reason not to invest in ML now?”

Developing Products at Silicon Valley Speed

Velocity Wins “Ideas are cheap. Execution is everything.” We’ve all heard this quote more than once: in seminars, board rooms, even on television. This is in part, I surmise, because it is particularly relevant to the fast-moving, dynamic world of entrepreneurs, ie.....

The 200 billion dollar chatbot disruption (part two)

In the last post, we highlighted the disruption that chatbot technologies are poised to make in call centers. To recap, we are seeing the trend that Generation X and Y have now shown a preference for text-based communication over voice. This results in consumers increasingly wanting to talk with brands via messaging platforms like Whatsapp and Facebook Messenger. Simultaneously, there has been an explosion of conversational A.I. technology tools and frameworks in which natural language processing can be used to automate customer support inquiries. As the last installment discussed, this trend provides a compelling opportunity for companies to drastically reduce the costs of running their call centers.